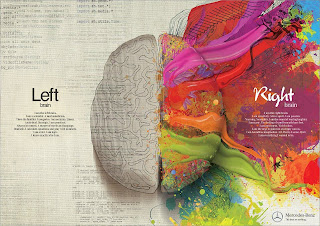

I saw this picture awhile ago but it was posted by my friend the other day on Facebook and it reminded me of how much both sides appeal/apply to me. Are you a lefty or righty?

The text for the left brain reads:

“I am the left brain. I am a scientist. A mathematician. I love the familiar. I categorize. I am accurate. Linear. Analytical. Strategic. I am practical. Always in control. A master of words and language. Realistic. I calculate equations and play with numbers. I am order. I am logic. I know exactly who I am.”

And for the right brain:

“I am the right brain. I am creativity. A free spirit. I am passion. Yearning. Sensuality. I am the sound of roaring laughter. I am taste. The feeling of sand beneath bare feet. I am movement. Vivid colors. I am the urge to paint on an empty canvas. I am boundless imagination. Art. Poetry. I sense. I feel. I am everything I wanted to be.”

Saturday, February 25, 2012

Wednesday, February 22, 2012

A Different Kind of Lent

This year I was challenged by my cousin Pam to try a different kind of Lent, the kind of lent where I give up 'stuff'. Coming from a dual pack-rat heritage (mom - saves the kind of things 'you might need one day', dad - saves everything 'collectable'), I have been trying to become more and more minimalist over the last 5 years or so but I still feel like there is still way too much 'stuff' around my house I don't need or even really want, I've compulsively kept it and then wonder WHY?!

So here is the challenge I am taking up for Lent, which starts today!

First I plan to find four boxes (about banker box size) and label them "DONATE", "TRASH", "REGIFT/RECYCLE", and "SELL", which I think will make sorting much easier than in bags, and then once the boxes are full I will bag them and deal with them accordingly. I'd already kindof started because I'm really excited for this chance to purge!! I think I'll use one of the Fly Lady tactics of "Love it or Leave it". If I don't love it then it needs to be gone.

Now, getting rid of it on the other hand is a different question, the stuff I know someone else might love is particularily tricky. Some things you just can't donate to Value Village or MCC, like my craft supplies. Do you give them movies/video games? Electronic wires? These are the things I'm already knowing I need to clean out but what to do with them?!

Watch out for some pics, and maybe even an online garage sale for my "SELL" stack ;)

So here is the challenge I am taking up for Lent, which starts today!

First I plan to find four boxes (about banker box size) and label them "DONATE", "TRASH", "REGIFT/RECYCLE", and "SELL", which I think will make sorting much easier than in bags, and then once the boxes are full I will bag them and deal with them accordingly. I'd already kindof started because I'm really excited for this chance to purge!! I think I'll use one of the Fly Lady tactics of "Love it or Leave it". If I don't love it then it needs to be gone.

Now, getting rid of it on the other hand is a different question, the stuff I know someone else might love is particularily tricky. Some things you just can't donate to Value Village or MCC, like my craft supplies. Do you give them movies/video games? Electronic wires? These are the things I'm already knowing I need to clean out but what to do with them?!

Watch out for some pics, and maybe even an online garage sale for my "SELL" stack ;)

Friday, February 17, 2012

"10 easy steps"

I sometimes wish there were "10 easy steps" to everything! But alas, I'll take what I can get. Thought a few ideas on this list were noteworthy and may make an appearance in my life over the next year, and was glad a few things I already do were on the list. Wanted to share, and keep a reminder for me as well. Thanks Tammi for posting this on Facebook :)

Monday, February 13, 2012

Meal Planning Monday

A few people have asked me about some of my meal planning tips and so here are a few for easier meals without sacrificing a lot of time and without using a lot of pre-processed foods.

1. Meat. You don't have to plan months of meals in advance to take advantage of OAMC (once a month cooking) tactics, you can start off small with just one meat that can be used in a bunch of different recipes.

I have a ground beef mix I make and use for 12 different recipes. I throw all the ingredients into a crockpot, cook it until it's still somewhat pink (and the chunks can be worked out with a fork), then just distribute the mix between 12 ziplock bags, it takes about 12 lbs, which I can JUST fit in my crockpot, to make enough for all 12 recipes.

Or, I get a turkey at post-holiday sale prices, roast it like you would your holiday turkey and you can get about 1 meal (for 2 people) per pound. I have about 14 recipes I can use leftover turkey in, I just pre-divide and package the meat into 15 ziplock bags. Not to mention, you can have a traditional turkey dinner anytime, I add stuffing to my turkey, then freeze it with the drumsticks/wings, freeze some baked potatoes, package it all together and I include this as one of my planned meals. Mmmm, turkey dinner in July :)

Both of those options are just one day of work which would do most of the work ahead of time for about 2 weeks worth of meals. As you get more experienced you could probably fit them both into one day since you basically don't do much as the meat's cooking. You could start cooking one and then just before it's done, start cooking the other, then you can package the meat that's finished while the other one cooks.

2. Easy & Healthy - You may have a lot of easy recipes, but they are easy because they have you dump pre-processed soups,dressings, and sauces, preservatives, etc. into your dish. I wanted easy but healthy so I searched for substitutions for my previous go-to ingredients. Most are made with ingredients I typically have in my pantry anyway but to save time I have pre-mixed a lot of these as dry ingredients (stored as mixes) and then when I need them I only have to mix in the wet ingredients to get my sauce, and I only need to make as much as I need, so less wasted food! And I can pronounce and know exactly what is in every one of these.

Condensed Soup substitute - this would replace the base, if you want the flavor (cream of ....chicken, mushroom, asparagus, cheese, etc.) then you could add that actual ingredient into the powder/water mix. I found this one courtesy of Pinterest of course :)

Tomato Condensed Soup substitute - this one is just for my mom, who upon hearing about the above sub immediately wanted to know, 'but what about tomato soup'. here you go! I haven't tried it yet but it had a lot of good reviews.

Dry Onion Soup Mix substitute - when I mix this to get a soup or a wet base I mix it with my homemade broth.

Boullion Cube substitute - I only use this when it calls for dry boullion, otherwise I just use my own homemade broth.

Evaporated/Condensed Milk - because I usually have these ingredients on hand and then I can make the quantity I need rather than buy a whole container.

Apricot Jam (or any jam) - apricots (soaked in water until soft) or can of apricots (stored in water, no sugar/syrup), 1 tbsp honey, puree in blender. I pour these into an ice cube tray and then once frozen I pop them out and store them in a ziplock bag and use 1 cube as 1 tbsp.

Salad Dressings substitute - again, easier to have these ingredients on hand than a bunch of bottles of dressing, and I can control how much sugar I want to add. These of course are just my staple dressings that I use in the most recipes....not typically dressings I add to my salads.

Hope this makes some of your lives easier and healthier!

1. Meat. You don't have to plan months of meals in advance to take advantage of OAMC (once a month cooking) tactics, you can start off small with just one meat that can be used in a bunch of different recipes.

I have a ground beef mix I make and use for 12 different recipes. I throw all the ingredients into a crockpot, cook it until it's still somewhat pink (and the chunks can be worked out with a fork), then just distribute the mix between 12 ziplock bags, it takes about 12 lbs, which I can JUST fit in my crockpot, to make enough for all 12 recipes.

Or, I get a turkey at post-holiday sale prices, roast it like you would your holiday turkey and you can get about 1 meal (for 2 people) per pound. I have about 14 recipes I can use leftover turkey in, I just pre-divide and package the meat into 15 ziplock bags. Not to mention, you can have a traditional turkey dinner anytime, I add stuffing to my turkey, then freeze it with the drumsticks/wings, freeze some baked potatoes, package it all together and I include this as one of my planned meals. Mmmm, turkey dinner in July :)

Both of those options are just one day of work which would do most of the work ahead of time for about 2 weeks worth of meals. As you get more experienced you could probably fit them both into one day since you basically don't do much as the meat's cooking. You could start cooking one and then just before it's done, start cooking the other, then you can package the meat that's finished while the other one cooks.

2. Easy & Healthy - You may have a lot of easy recipes, but they are easy because they have you dump pre-processed soups,dressings, and sauces, preservatives, etc. into your dish. I wanted easy but healthy so I searched for substitutions for my previous go-to ingredients. Most are made with ingredients I typically have in my pantry anyway but to save time I have pre-mixed a lot of these as dry ingredients (stored as mixes) and then when I need them I only have to mix in the wet ingredients to get my sauce, and I only need to make as much as I need, so less wasted food! And I can pronounce and know exactly what is in every one of these.

Condensed Soup substitute - this would replace the base, if you want the flavor (cream of ....chicken, mushroom, asparagus, cheese, etc.) then you could add that actual ingredient into the powder/water mix. I found this one courtesy of Pinterest of course :)

Tomato Condensed Soup substitute - this one is just for my mom, who upon hearing about the above sub immediately wanted to know, 'but what about tomato soup'. here you go! I haven't tried it yet but it had a lot of good reviews.

Dry Onion Soup Mix substitute - when I mix this to get a soup or a wet base I mix it with my homemade broth.

Boullion Cube substitute - I only use this when it calls for dry boullion, otherwise I just use my own homemade broth.

Evaporated/Condensed Milk - because I usually have these ingredients on hand and then I can make the quantity I need rather than buy a whole container.

Apricot Jam (or any jam) - apricots (soaked in water until soft) or can of apricots (stored in water, no sugar/syrup), 1 tbsp honey, puree in blender. I pour these into an ice cube tray and then once frozen I pop them out and store them in a ziplock bag and use 1 cube as 1 tbsp.

Salad Dressings substitute - again, easier to have these ingredients on hand than a bunch of bottles of dressing, and I can control how much sugar I want to add. These of course are just my staple dressings that I use in the most recipes....not typically dressings I add to my salads.

Hope this makes some of your lives easier and healthier!

Sunday, February 12, 2012

Sunday Stewardship Update

Just a quick update on my stewardships.

Finances - to organize my wallet Dave Ramsey style I've previously used the cash envelopes but they rip so easily so I wanted to come up with a more sturdy version. A girl in my class sewed cloth envelopes with zippers but then I couldn't see inside them where I'd like to still keep a tally sheet, so I thought of the clear envelopes with zipper seals I often get in cosmetic bags, found them online for $1.75 each! Then I went to Value Village, found a wallet I can repurpose to fit these plastic envelopes into. I hope to finish this weekend!

Home - small groups haven't started yet so I haven't stricly followed my cleaning plan because a couple of other projects have topped my priority list and they are covering my dining room table :) But my living room has just seemed to stay tidy for a change, which is nice.

My meal planning is finally done (the majority of it anyway, I've written a whole seperate post on that, coming soon). And I even have a meal planning board I made (with inspiration from Pinterest of course). I bought the frame at Value Village as well, took out the old painting, painted/antiqued the frame to my liking, then added some of my fav pieces of scrapbooking paper behind so I have 5 blocks for the 5 days of the week I plan for.

Just need hubby to hang it up and I can start using my cute Dollorama dry erase markers to layout my plan a week at a time.

I also talk about my food from scratch in my meal plan post, other than that I haven't added anything new to my repetoire yet.

Body - I have actually really been slacking on the exercise, especially the 6 am strength training sessions, I really need to be more disciplined about going to bed at a reasonable time instead of getting carried away with all my fun projects! I haven't been on the treadmill for over a week either. Where are my discipline inspirational quotes when I need them!

I am however doing fairly well on my eating plan, sticking about 98% to the foods I should/should not eat, and I'm STILL not counting calories!! I feel like I'm doing so well in fact I felt confident enough in my weight maintaining to purchase a second pair of pants at my new lower size and I now am that size from 2 different stores! Lol. Don't you hate it when one store says you are one size, and another says you are a different size? I love the validation I actually have shrunk a size :)

I'm also doing well on cutting out caffeine, I've only had a partial cup because I wanted a hot drink and tea wasn't sweet enough but hot chocolate was too sweet, so I had a cafe mocha. Not bad, less than a cup in 42 days!

Earth - I was able to buy that grass fed beef from a local farm and I really liked it! After pricing out the difference I think it was well worth the slight cost difference and I'm going to keep purchasing from there. That means I should have a mostly local meal at least once per month because I'm sure to use local potatoes and carrots with at least one of my beef recipes that often.

I've found more ways to conserve water, like the water I use to rinse the coffee carafe I let soak all day (coffee is a really tough stain to remove if I don't), and then I use that water to rinse Sean's coffee thermos at the end of the day, and also rinse out the re-usable coffee filter. I'm trying to think of reuses like this for water and change my thinking about how 'disposable' water is. My only beef is with our water tap it takes too long for water to get from hot to cold or cold to hot...wastes a lot of water that way. I try to use some of that for soaking dirty dishes but even after they are filled the water still isn't at the right temp sometimes. :(

Talents/Purpose - I've been doing my best to blog the moments I want to remember, but funny enough, a lot of the moments I want to remember are just a lot of warm fuzzies between hubby and I lately, or a great chat with a great friend, most of which are too personal to share here. I guess I should remember to write those ones in the journals : / Or, I have posts about things that are not done yet, like a pile of gifts for a friend about to have a baby...but can't share it until she has that baby! I do however have a few larger posts I'd been working on for some time finally scheduled so I can start concentrating on the little daily entries....or I'll try!

I am super pumped and busy with a new creative outlet though! I joined a Facebook challenge from a friend for a 'Hand-made Pay-It-Forward', where the first 5 people to comment on the offer would receive something handmade by in 2012, and so I commented to receive something from her and then paid it forward and offered the challenge on FB as well. I threw a bunch of ideas around but then I stumbled on an idea on Pinterest (gotta love that Pinterest!) and at first thought it was a perfect addition to the stack of gifts for my friend who's having the baby, but then I realized the potential I could create out of this idea. I bought all the supplies and started on my first one and oh do I love it! Not only the finished product but I loved the process, wondering at each step of the creative choices, if it will look the way I hope, and just watching it develope into something beautiful at my hand. I have SO missed the feeling of creating like that! I'll defintely have a whole post of all the items I give and receive...because I 'signed up' for other friends who then paid it forward as well. I can't wait!

Communities - So our January date was Sean's turn and we ended up having a 'shoulder-shoulder' date and we didn't get a 'face to face' time, however we did have a long car ride and talk which I actually like just as much as the 'face to face', so I'll chalk January up to be a success with the his and hers connections.

Have definitely been keeping up with the couple-friend community, had an evening with one of our good couple friends and have a date for another evening of fun with a different couple friend for the end of Feb. Need to squeeze in some time with my girlfriends though....don't be surprised if one of you gets a call :)

And we invited 2 couples over from Church for a potluck dinner but it probably won't work until March.

Also just had a conversation with our ministry director about the women I will be starting a small group with for recovery, hopefully that will be starting in 2-3 weeks as well! Yay! Sean still hasn't decided if he wants to start leading a small group or if he'll be joining another one already in progress.

Growth - my media fast on Tuesdays has been mostly successful, although it's hard to get Sean to turn off the t.v. for a few shows he enjoys so sometimes, even if I'm off in the dining room I can get a little sucked in. BUT, at least I have been off the couch every Tuesday, I have spent it finishing the meal plans, reading, creating, organizing. It's amazing how one evening a week on that stuff can make me feel so much more productive than I used to feel :) I really do find myself also growing, I feel like I want to sit on the couch less in general, I don't like vegging in front of my computer for as many hours as I used to, and t.v. is slowly losing it's appeal....I've stopped Grey's Anatomy watching, and when other shows are not on I have been better at not just replacing them with something new.

I've now got 2 books on the go, both non-fiction - The Case for the Real Jesus, and Poetic Medicine. Both really good....but unfortunately my creative and meal planning endevors have cut my reading hours short. I think this upcoming Tuesday I will at least pick up one! Same with my Bible, now that I have a Bible I need to 'chew', it's hard to just read a chapter, it took me half an hour to get through one chapter!

My prayer time has been intentional but interesting, because I have the new listening prayer techniques I feel like I'm just getting started and then my 'time is up'. I need to practice shutting off my mind faster - maybe use some meditation tips I heard about. But I'm adapting, trying to find ways to keep it a part of every day.

Living my Life - I've mostly been spending time trying to pay attention to what I feel I need in the moment, if I need a time just to let my body rest I finally let myself veg, list be damned, or if I've been vegging too much I get off my butt and look at my list until something appeals to me. If I've been needing social time I take some time to visit with people, even if it's through emails, or squeezing in some extra time before or after Church.

I did pamper myself, getting a manicure early in January, a french gel mani, which I loved how it looked but I just don't have the kind of time for maintenance it requires. Wish I did, I really liked them.

In addition to that, I'm feeling like I'm becoming more high maintenance these days, as my hair has been harder to upkeep than I thought it would be after cutting out the salon cost from my budget. The box bleaching I've got down but the hair cuts are hard! I really only need a short trim and I'm going to have to pay $30ish for it! I refuse to do the Magic-Cuts thing, and even that is $18. Is it just me or is that much money for cutting an inch of hair ridiculous! I'd go to a hair school but they are only open when I work.

I'm also going to pamper myself with a short road trip. It's really short, like only 30 min. outside the city, but it's my turn to plan the anniversary date and I really wanted us to 'get away' from it all, be far removed from everything 'usual' and be holed up together for a full 24 hours. I found a nice little place I can't wait to try out, they have a great deal if you don't stay a Friday or Saturday so we're taking the Monday after off and going Sun-Mon., for only $59/night! We really like being on the road together so even the trip there and back will be nice.

Finances - to organize my wallet Dave Ramsey style I've previously used the cash envelopes but they rip so easily so I wanted to come up with a more sturdy version. A girl in my class sewed cloth envelopes with zippers but then I couldn't see inside them where I'd like to still keep a tally sheet, so I thought of the clear envelopes with zipper seals I often get in cosmetic bags, found them online for $1.75 each! Then I went to Value Village, found a wallet I can repurpose to fit these plastic envelopes into. I hope to finish this weekend!

Home - small groups haven't started yet so I haven't stricly followed my cleaning plan because a couple of other projects have topped my priority list and they are covering my dining room table :) But my living room has just seemed to stay tidy for a change, which is nice.

My meal planning is finally done (the majority of it anyway, I've written a whole seperate post on that, coming soon). And I even have a meal planning board I made (with inspiration from Pinterest of course). I bought the frame at Value Village as well, took out the old painting, painted/antiqued the frame to my liking, then added some of my fav pieces of scrapbooking paper behind so I have 5 blocks for the 5 days of the week I plan for.

Just need hubby to hang it up and I can start using my cute Dollorama dry erase markers to layout my plan a week at a time.

I also talk about my food from scratch in my meal plan post, other than that I haven't added anything new to my repetoire yet.

Body - I have actually really been slacking on the exercise, especially the 6 am strength training sessions, I really need to be more disciplined about going to bed at a reasonable time instead of getting carried away with all my fun projects! I haven't been on the treadmill for over a week either. Where are my discipline inspirational quotes when I need them!

I am however doing fairly well on my eating plan, sticking about 98% to the foods I should/should not eat, and I'm STILL not counting calories!! I feel like I'm doing so well in fact I felt confident enough in my weight maintaining to purchase a second pair of pants at my new lower size and I now am that size from 2 different stores! Lol. Don't you hate it when one store says you are one size, and another says you are a different size? I love the validation I actually have shrunk a size :)

I'm also doing well on cutting out caffeine, I've only had a partial cup because I wanted a hot drink and tea wasn't sweet enough but hot chocolate was too sweet, so I had a cafe mocha. Not bad, less than a cup in 42 days!

Earth - I was able to buy that grass fed beef from a local farm and I really liked it! After pricing out the difference I think it was well worth the slight cost difference and I'm going to keep purchasing from there. That means I should have a mostly local meal at least once per month because I'm sure to use local potatoes and carrots with at least one of my beef recipes that often.

I've found more ways to conserve water, like the water I use to rinse the coffee carafe I let soak all day (coffee is a really tough stain to remove if I don't), and then I use that water to rinse Sean's coffee thermos at the end of the day, and also rinse out the re-usable coffee filter. I'm trying to think of reuses like this for water and change my thinking about how 'disposable' water is. My only beef is with our water tap it takes too long for water to get from hot to cold or cold to hot...wastes a lot of water that way. I try to use some of that for soaking dirty dishes but even after they are filled the water still isn't at the right temp sometimes. :(

Talents/Purpose - I've been doing my best to blog the moments I want to remember, but funny enough, a lot of the moments I want to remember are just a lot of warm fuzzies between hubby and I lately, or a great chat with a great friend, most of which are too personal to share here. I guess I should remember to write those ones in the journals : / Or, I have posts about things that are not done yet, like a pile of gifts for a friend about to have a baby...but can't share it until she has that baby! I do however have a few larger posts I'd been working on for some time finally scheduled so I can start concentrating on the little daily entries....or I'll try!

I am super pumped and busy with a new creative outlet though! I joined a Facebook challenge from a friend for a 'Hand-made Pay-It-Forward', where the first 5 people to comment on the offer would receive something handmade by in 2012, and so I commented to receive something from her and then paid it forward and offered the challenge on FB as well. I threw a bunch of ideas around but then I stumbled on an idea on Pinterest (gotta love that Pinterest!) and at first thought it was a perfect addition to the stack of gifts for my friend who's having the baby, but then I realized the potential I could create out of this idea. I bought all the supplies and started on my first one and oh do I love it! Not only the finished product but I loved the process, wondering at each step of the creative choices, if it will look the way I hope, and just watching it develope into something beautiful at my hand. I have SO missed the feeling of creating like that! I'll defintely have a whole post of all the items I give and receive...because I 'signed up' for other friends who then paid it forward as well. I can't wait!

Communities - So our January date was Sean's turn and we ended up having a 'shoulder-shoulder' date and we didn't get a 'face to face' time, however we did have a long car ride and talk which I actually like just as much as the 'face to face', so I'll chalk January up to be a success with the his and hers connections.

Have definitely been keeping up with the couple-friend community, had an evening with one of our good couple friends and have a date for another evening of fun with a different couple friend for the end of Feb. Need to squeeze in some time with my girlfriends though....don't be surprised if one of you gets a call :)

And we invited 2 couples over from Church for a potluck dinner but it probably won't work until March.

Also just had a conversation with our ministry director about the women I will be starting a small group with for recovery, hopefully that will be starting in 2-3 weeks as well! Yay! Sean still hasn't decided if he wants to start leading a small group or if he'll be joining another one already in progress.

Growth - my media fast on Tuesdays has been mostly successful, although it's hard to get Sean to turn off the t.v. for a few shows he enjoys so sometimes, even if I'm off in the dining room I can get a little sucked in. BUT, at least I have been off the couch every Tuesday, I have spent it finishing the meal plans, reading, creating, organizing. It's amazing how one evening a week on that stuff can make me feel so much more productive than I used to feel :) I really do find myself also growing, I feel like I want to sit on the couch less in general, I don't like vegging in front of my computer for as many hours as I used to, and t.v. is slowly losing it's appeal....I've stopped Grey's Anatomy watching, and when other shows are not on I have been better at not just replacing them with something new.

I've now got 2 books on the go, both non-fiction - The Case for the Real Jesus, and Poetic Medicine. Both really good....but unfortunately my creative and meal planning endevors have cut my reading hours short. I think this upcoming Tuesday I will at least pick up one! Same with my Bible, now that I have a Bible I need to 'chew', it's hard to just read a chapter, it took me half an hour to get through one chapter!

My prayer time has been intentional but interesting, because I have the new listening prayer techniques I feel like I'm just getting started and then my 'time is up'. I need to practice shutting off my mind faster - maybe use some meditation tips I heard about. But I'm adapting, trying to find ways to keep it a part of every day.

Living my Life - I've mostly been spending time trying to pay attention to what I feel I need in the moment, if I need a time just to let my body rest I finally let myself veg, list be damned, or if I've been vegging too much I get off my butt and look at my list until something appeals to me. If I've been needing social time I take some time to visit with people, even if it's through emails, or squeezing in some extra time before or after Church.

I did pamper myself, getting a manicure early in January, a french gel mani, which I loved how it looked but I just don't have the kind of time for maintenance it requires. Wish I did, I really liked them.

In addition to that, I'm feeling like I'm becoming more high maintenance these days, as my hair has been harder to upkeep than I thought it would be after cutting out the salon cost from my budget. The box bleaching I've got down but the hair cuts are hard! I really only need a short trim and I'm going to have to pay $30ish for it! I refuse to do the Magic-Cuts thing, and even that is $18. Is it just me or is that much money for cutting an inch of hair ridiculous! I'd go to a hair school but they are only open when I work.

I'm also going to pamper myself with a short road trip. It's really short, like only 30 min. outside the city, but it's my turn to plan the anniversary date and I really wanted us to 'get away' from it all, be far removed from everything 'usual' and be holed up together for a full 24 hours. I found a nice little place I can't wait to try out, they have a great deal if you don't stay a Friday or Saturday so we're taking the Monday after off and going Sun-Mon., for only $59/night! We really like being on the road together so even the trip there and back will be nice.

Friday, February 10, 2012

Financial Friday - Things I learned from Dave Ramsey

Since last October I have been attending weekly sessions at Church of Dave Ramsey's Financial Peace University. Being that I:

a) was raised Accountant, oops, I mean BY an Accountant (budgeting babysitting money on financial graph paper when I was 12), and

b) am financially hypervigelant (being that I learned from my 2 years of carelessly letting someone run my finances reactively, and being that I'm a geek),

I've been a follower of financial blogs and have been budgeting on a coloured, multi-tabbed spreadsheet for several years.

I was hopeful I would get something out of the course, like in the area of investing or saving for retirement, areas I was pretty sure I knew very little about. But I was even finding very useful tips with budgeting! This is what I thought I already excelled at! Granted I was 10 steps ahead of people who didn't budget at all, but frankly I was surprised how much more there was to learn about budgeting that I hadn't.

So, anyway, here is a brief summary of the great tips I have already implemented, or will as soon as I can.

1) Emergengy Funds - this isn't just one step, there are a bunch of little steps, but the most important first thing to do is to have $1000 in savings because unexpected events are 100% guarenteed to happen. On average a significant (about $1000) cost unexpectantly happens to people at least every 10 years. Most people use credit card for these unexpected costs, that's their 'emergency fund', but as you'll see in the next step, that's the worst thing you can do.

a) As your budget allows you will want to start sub-divisions of further emergency savings, also called a sinking fund approach, or self-insurance. i.e. a fund for home/car repair/maintenance, a fund for purchasing a new/replacement vehicle, furniture, Christmas gifts, property tax, etc. Anything that blows the budget but you can anticipate it coming. I did this on a very small scale but have now added so many self-insurance categories to my budget.

b) After debt is all paid off come back and save some more, save 3-6 months of expenses (necessary expenses to live on, not spending). This is in case of even bigger unexpected events, like unable to work due to illness, unemployment (taking a lower paying job), large financial loss, etc. Again, this is self-insuring yourself against life, an emergency fund is not an investment (don't place it in an account with penalties for withdrawl), DO NOT touch it for anything other than a real emergency.

2) Budget - If you hate that term, call it Cash Flow Planning :)

a) The very first entries into your cash plan, your priorities, should be the 'four walls', the necesseties needed to live, recommended % of net income shown in brackets after: Food (5-15%), Shelter/Utilities (30-45%), Clothing -bare minimum (2-5%) and Transportation -needed for work (10-15%). Total percent of the four walls shouldn't be more than 65%.

b) Every penny of income needs to be accounted for in the plan, budget each month until a zero balance. Tracking every last expendature will help you figure out where you are overspending or not planning for things you could be prepared for. Here is Dave's 'Monthly Cash Flow Plan' online, it mentions some categories even I hadn't remembered to put in my budget.

c) Using cash makes it easier to stick to the budget, paying with ATM/debit or credit automatically increases $$ transactions. The envelope system for cash allows instant tracking and when the cash runs out the spending stops. Challenge yourself to use cash in the areas you typically overspend if you feel you can't move to a complete cash budget right away.

3) Dump the Debt - these are actually more like reasons not to dump debt with a few tips on how.

a) Saving vs. Loan payment - a loan purchase of $4000 has $211 monthly payments at 24% for 24 months, end up paying $5064 in total. Saving $211 for 19 months will equal $4000. Will save you $1064 and 5 months of $211 in expenses.

b) Paying interest vs. Earning interest - that same $1064, if you saved it instead of paying it, invested from age 25 to 65 at 6% interest would earn over $10,000, at 12% would earn over $95,000.

c) Credit is marketed to us as a need, they make billions off us in interest. Credit scores are not necessary, you can be a millionaire but with paying for everything with your cash you will have a bad credit score. Creditors are hunting for the weakest pray, be strong and realize you don't need it.

d) Once you have a $1000 emergency fund, immediately stop borrowing, do not take on any more debt.

e) Pay off all your debt (other than mortgage) with the Debt Snowball. Paying off smallest debts first, then applying those payments to the next lowest debt and so on. Proverbs 6:1-5 - you may wander or stumble into debt but you need to run with gazelle like intensity to escape the hunter. You may have to sell something(s) or get more income temporarily, depending on the amount of debt you have, but if you don't escape it, continually paying the interest on that debt will stalk your financial peace and ability to take care of yourself in retirement.

4) Make Smarter Purchases - the less you spend the more you can save....for more peaceful spending later :)

a) Don't buy into marketing tactics, most 'great deals' have so many strings that less than 10% of people actually qualify. Get at least 3 quotes and wait overnight before making a large purchase.

b) Carefully consider your buying motives, pay attention to the physiological responses your body makes with big purchases, do not buy because of the way things make you feel, do not medicate with stuff.

c) Consider the 'opportunity cost'. Dave Ramsey gave the example of a young man who got a well paying job early in life, saved enough for a $40,000 mercedes but in the end liked having the security of the money instead, invested wisely and about12 years later pulled up next to a guy in in the exact year mercedes he had wanted, the guy had bought it for $4,000 and he had $300, 000 in his savings.

d) Purchasing impulsively is immaturity, like a child getting upset if they can't get what they want. Adults can still get what they want but are mature about it and plan to purchase it in the smartest way.

e) Cash is king - it's visual, it's emotional and it's immediate, people will reduce prices for payment in cash because they only get a percent of what's put on credit. With cash you feel the power to walk away if the 'deal' is not good enough.

f) Bargain hunt, in addition to comparison shopping, try to buy used before new (always use common sense with this, not with safety items, particularily baby cribs, seats, etc.), and don't be afraid of negotiating (almost all world markets other than America's run this way).

5) Investing - first rule of investing, keep it simple

a) Just like your self insurance should not be considered an investment, your investments should not be mixed with your real life insurance. Life insurance should be only life insurance, only covering income someone would lose should you die (or income you would lose should your spouse die). It should not be permanent, if you are smart about your money eventually you will not need this 'income replacement insurance', so do not get the 'cash value' building insurance, all you need is a term policy (recommended 10 x salary you are replacing, invested at about 10% should provide annual income through interest)

b) Start as soon as you can (after 4 walls and debt, other than mortgage, gone) because the first big factor in investing is time, compound interest works in favor of time, no matter how little you start putting away. Aim for 15% of your income, but start with any extra you have - for the cost of a $3 coffee every day over 60 years you could earn in interest (estimating 12%) $11 million dollars.

c) Diversify your investments - the general recommendation (not taking age into account) is 25% in an income fund (low risk, lower rate of return), 25% growth (medium risk, mid-range rate of return), 25% aggressive growth (high risk, high rate of return), 25% international (in case domestic funds in economic slump). This is a typical standard for mutual fund diversification.

d) Mutual funds are a managed pool of investors, giving the benefit of experienced market analysts and power of 'big purchases', so they typically have better rates and are less risky, they have more stable performance and are good long term investments.

e) Property/Real Estate is only a good investment if you already have a lot of liquid assets as it is one of the investments that ties your money up for a great length of time. If you buy a home though, treat it like an investment, get inspections and surveys done, be smart about it, only 'invest' in a house you could 'unload' quickly if need be.

Just a reminder this is a very abridged summary of my highlights from 13 weeks of video and reading his book, there were many other nuggets of information that were tucked in there that may be even more beneficial for you than they were for me so I highly suggest taking the course or reading his book. As Dave says, living like no one else now (in a disciplined way) and later you can live like no one else (in financial freedom to afford whatever you need/want). Also, he admittedly isn't the end all be all of finance advice, feel free to keep researching for more information, he always advises talking to experts so you can get advise based on your specific situation.

Best of luck!

a) was raised Accountant, oops, I mean BY an Accountant (budgeting babysitting money on financial graph paper when I was 12), and

b) am financially hypervigelant (being that I learned from my 2 years of carelessly letting someone run my finances reactively, and being that I'm a geek),

I've been a follower of financial blogs and have been budgeting on a coloured, multi-tabbed spreadsheet for several years.

I was hopeful I would get something out of the course, like in the area of investing or saving for retirement, areas I was pretty sure I knew very little about. But I was even finding very useful tips with budgeting! This is what I thought I already excelled at! Granted I was 10 steps ahead of people who didn't budget at all, but frankly I was surprised how much more there was to learn about budgeting that I hadn't.

So, anyway, here is a brief summary of the great tips I have already implemented, or will as soon as I can.

1) Emergengy Funds - this isn't just one step, there are a bunch of little steps, but the most important first thing to do is to have $1000 in savings because unexpected events are 100% guarenteed to happen. On average a significant (about $1000) cost unexpectantly happens to people at least every 10 years. Most people use credit card for these unexpected costs, that's their 'emergency fund', but as you'll see in the next step, that's the worst thing you can do.

a) As your budget allows you will want to start sub-divisions of further emergency savings, also called a sinking fund approach, or self-insurance. i.e. a fund for home/car repair/maintenance, a fund for purchasing a new/replacement vehicle, furniture, Christmas gifts, property tax, etc. Anything that blows the budget but you can anticipate it coming. I did this on a very small scale but have now added so many self-insurance categories to my budget.

b) After debt is all paid off come back and save some more, save 3-6 months of expenses (necessary expenses to live on, not spending). This is in case of even bigger unexpected events, like unable to work due to illness, unemployment (taking a lower paying job), large financial loss, etc. Again, this is self-insuring yourself against life, an emergency fund is not an investment (don't place it in an account with penalties for withdrawl), DO NOT touch it for anything other than a real emergency.

2) Budget - If you hate that term, call it Cash Flow Planning :)

a) The very first entries into your cash plan, your priorities, should be the 'four walls', the necesseties needed to live, recommended % of net income shown in brackets after: Food (5-15%), Shelter/Utilities (30-45%), Clothing -bare minimum (2-5%) and Transportation -needed for work (10-15%). Total percent of the four walls shouldn't be more than 65%.

b) Every penny of income needs to be accounted for in the plan, budget each month until a zero balance. Tracking every last expendature will help you figure out where you are overspending or not planning for things you could be prepared for. Here is Dave's 'Monthly Cash Flow Plan' online, it mentions some categories even I hadn't remembered to put in my budget.

c) Using cash makes it easier to stick to the budget, paying with ATM/debit or credit automatically increases $$ transactions. The envelope system for cash allows instant tracking and when the cash runs out the spending stops. Challenge yourself to use cash in the areas you typically overspend if you feel you can't move to a complete cash budget right away.

3) Dump the Debt - these are actually more like reasons not to dump debt with a few tips on how.

a) Saving vs. Loan payment - a loan purchase of $4000 has $211 monthly payments at 24% for 24 months, end up paying $5064 in total. Saving $211 for 19 months will equal $4000. Will save you $1064 and 5 months of $211 in expenses.

b) Paying interest vs. Earning interest - that same $1064, if you saved it instead of paying it, invested from age 25 to 65 at 6% interest would earn over $10,000, at 12% would earn over $95,000.

c) Credit is marketed to us as a need, they make billions off us in interest. Credit scores are not necessary, you can be a millionaire but with paying for everything with your cash you will have a bad credit score. Creditors are hunting for the weakest pray, be strong and realize you don't need it.

d) Once you have a $1000 emergency fund, immediately stop borrowing, do not take on any more debt.

e) Pay off all your debt (other than mortgage) with the Debt Snowball. Paying off smallest debts first, then applying those payments to the next lowest debt and so on. Proverbs 6:1-5 - you may wander or stumble into debt but you need to run with gazelle like intensity to escape the hunter. You may have to sell something(s) or get more income temporarily, depending on the amount of debt you have, but if you don't escape it, continually paying the interest on that debt will stalk your financial peace and ability to take care of yourself in retirement.

4) Make Smarter Purchases - the less you spend the more you can save....for more peaceful spending later :)

a) Don't buy into marketing tactics, most 'great deals' have so many strings that less than 10% of people actually qualify. Get at least 3 quotes and wait overnight before making a large purchase.

b) Carefully consider your buying motives, pay attention to the physiological responses your body makes with big purchases, do not buy because of the way things make you feel, do not medicate with stuff.

c) Consider the 'opportunity cost'. Dave Ramsey gave the example of a young man who got a well paying job early in life, saved enough for a $40,000 mercedes but in the end liked having the security of the money instead, invested wisely and about12 years later pulled up next to a guy in in the exact year mercedes he had wanted, the guy had bought it for $4,000 and he had $300, 000 in his savings.

d) Purchasing impulsively is immaturity, like a child getting upset if they can't get what they want. Adults can still get what they want but are mature about it and plan to purchase it in the smartest way.

e) Cash is king - it's visual, it's emotional and it's immediate, people will reduce prices for payment in cash because they only get a percent of what's put on credit. With cash you feel the power to walk away if the 'deal' is not good enough.

f) Bargain hunt, in addition to comparison shopping, try to buy used before new (always use common sense with this, not with safety items, particularily baby cribs, seats, etc.), and don't be afraid of negotiating (almost all world markets other than America's run this way).

5) Investing - first rule of investing, keep it simple

a) Just like your self insurance should not be considered an investment, your investments should not be mixed with your real life insurance. Life insurance should be only life insurance, only covering income someone would lose should you die (or income you would lose should your spouse die). It should not be permanent, if you are smart about your money eventually you will not need this 'income replacement insurance', so do not get the 'cash value' building insurance, all you need is a term policy (recommended 10 x salary you are replacing, invested at about 10% should provide annual income through interest)

b) Start as soon as you can (after 4 walls and debt, other than mortgage, gone) because the first big factor in investing is time, compound interest works in favor of time, no matter how little you start putting away. Aim for 15% of your income, but start with any extra you have - for the cost of a $3 coffee every day over 60 years you could earn in interest (estimating 12%) $11 million dollars.

c) Diversify your investments - the general recommendation (not taking age into account) is 25% in an income fund (low risk, lower rate of return), 25% growth (medium risk, mid-range rate of return), 25% aggressive growth (high risk, high rate of return), 25% international (in case domestic funds in economic slump). This is a typical standard for mutual fund diversification.

d) Mutual funds are a managed pool of investors, giving the benefit of experienced market analysts and power of 'big purchases', so they typically have better rates and are less risky, they have more stable performance and are good long term investments.

e) Property/Real Estate is only a good investment if you already have a lot of liquid assets as it is one of the investments that ties your money up for a great length of time. If you buy a home though, treat it like an investment, get inspections and surveys done, be smart about it, only 'invest' in a house you could 'unload' quickly if need be.

Just a reminder this is a very abridged summary of my highlights from 13 weeks of video and reading his book, there were many other nuggets of information that were tucked in there that may be even more beneficial for you than they were for me so I highly suggest taking the course or reading his book. As Dave says, living like no one else now (in a disciplined way) and later you can live like no one else (in financial freedom to afford whatever you need/want). Also, he admittedly isn't the end all be all of finance advice, feel free to keep researching for more information, he always advises talking to experts so you can get advise based on your specific situation.

Best of luck!

Wednesday, February 8, 2012

Right Now

I'm playing on Pinterest today....how's this for optimism?

I couldn't deny it any longer, there were some Pins I just couldn't help but Pin, so I had to make an album.

I couldn't deny it any longer, there were some Pins I just couldn't help but Pin, so I had to make an album.

Monday, February 6, 2012

Miscellany Monday

~ well, it's been over a month again since I did this catch up, maybe I'll have to call this Miscellany Monday Monthly! by now I've forgotten all that has happened since just before Christmas!

~ New Year's we did our usual thing and stayed in with Chinese food and video games. we really like the low key start to a new year after the hulabaloo and chaos of Christmas gatherings for almost an entire month. plus we stay off the road where drunk driving is still way too much of a problem.

and this was someone else's lemon tort, but it was so cute I had to take a pic.

~ then at work we have 2 co-workers, Tanyss and Cam, who have babies due the same day at the end of January, so the 13th was Tanyss' last day at work. I spent most of that week putting together a double shower including gifts and planning lunch for her last day. these are the gift baskets, including scrapbooking kits I put together from my stash I'm selling off.

Yes I also made the cards in each gift basket, no I did not make the cupcakes, credit for those goes to Alex.

~ last night I made this gem I've been eyeing on Pinterest for awhile! awesome idea and soooo yummy ;)

~ the rest of January was spent finishing up the Financial Peace course at Church (I will have a blog on that soon enough :), a few visits with friends, and finishing up my meal plans so that I could finally do my big shop/cook/pack weekend.....which started last Saturday and has now turned into almost a full week. Only Thur. and Fri. weren't spent on it because I had Celebrate Recovery meetings. it's a little exhausting being on your feet that many nights in a row but I know it will be worth it for the next 22 weeks when I've got 6 days of meals planned for every one of those weeks!

~oh, and one last thing, Happy Birthday to my sister Jodi!! today is her 31st birthday.

Subscribe to:

Posts (Atom)